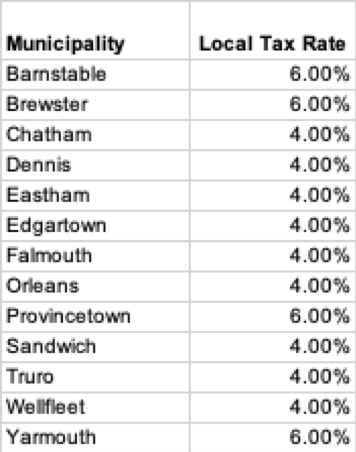

Even agents do not realize that insurance companies will refuse to pay claims if it involves a short term rental and the policy is a traditional homeowner policy. The tax went into effect on January 1, 2019. We have the tax listed in the lease based on the rental cost. Any homes located in Off-Cape townsare also not subject to the Wastewater Tax. You can enter information for one property or you can upload a consolidated return for multiple properties using Excel. The room occupancy excise tax applies to room rentals of 90 days or less in hotels, motels, bed and breakfast establishments, and lodging houses. Taxable items include the rent and any other non-refundable charges, including cleaning, linen, or pet fees. Cities and towns are required to notify DOR of any rate or fee changes using the notification of acceptance forms for room occupancy and community impact fee. If you do withhold any of it, you will be responsible for paying the tax on the amount you withhold. Operators will enter a list of their properties and receive a registration certificate for each one. Cities and towns are required to notify DOR of any rate or fee changes using the notification of acceptance forms for, . Should renters send a separate check for the taxes? Payment of the tax must be online, and the only way to submit it is to log in to the account that is created when you register. And that is their final answer. (I asked them twice just to be sure.). If your carrier does not provide the required $1M liability coverage, you might need to take out an umbrella policyto supplement your current policy, or switch to a different provider. See video tutorials for how to file and pay and how to upload a spreadsheet. And keep in mind that renters will have to pay this tax no matter which home they choose. Registration with DOR is not required. A return is only required to be filed for a month that tax is due. The tax is the total of these taxes: Are there any exemptions to the law? What a pain the law is making us change/add to insurance policies FYI, my insurance broker, who also has a rental on the Cape, said there are many options & one of the easiest (if my out of state primary residence insurer will allow) is an umbrella policy on the primary residence to make up the difference up to $1 mil liability on the rental property. The info regarding the lodging tax payment due August 20th notes, in pertinent part: Even if you have no taxes due for July, log into your account and indicate 0 taxes due. Intermediaries must also make sure the operator they are working for is registered with the Department before collecting any rent from theoccupant. (See a link to the how-to tutorial videos below.). You can find more information about how to report and remit amounts collected in response to local rate changes in the regulation. How should I present the tax on my listing? For more information, visitNew Due Date for Sales and Use Tax Returns. So, one of my guests, rents for 28 days in June, which I price relatively low ($200 less than my Summer Rate) It looks like she would be better off next year to rent for 32 days.  DOR maintains a current listing of all local rates and fees, called the. Beginning July 1, 2019, for short-term rentals only, cities and towns are permitted to charge an additional community impact fee up to 3% if an operator has more than one property in that locality or is renting an owner-occupied 2 or 3 family house on a short-term rental basis. ) or https:// means youve safely connected to the official website. The state will retain its 5.7% and remit the balance to your town. How do you interpret that? Check with your insurance agent to be sure that you have adequate insurance coverage. tax lodging cod cape does If I have 15 family members and friends that come to my home each year and share expenses do I have to charge a meals tax on the lobsters that I pay for? Hi, Duane, Short term refers to any rental period of 31 days or less. c. 62C, 16B. This is why WeNeedaVacation.com has never been against THIS PART of the Lodging Tax bill. Short-Term Lodging Tax Percentage by Town, Joan Talmadge - My husband Jeff and I created WeNeedaVacation.com in 1997, shortly after buying our Cape home. New Advance Payment Requirement for Vendors and Operators in G.L. To register, go to this registration page. If I didnt have any taxable rentals during the previous month, do I still need to file with MassTaxConnect? On line 2, taxable rent, do not include exempt rent from pre-January 1, 2019contracts. Just wondering if when you say collecting the lodging tax as a separate fee that means that we need to request a separate payment from the renter for the amount of the taxes or if we can accept a single payment that includes both rental fees and tax? 8:30 a.m.4:00 p.m., Monday through Friday, Text of the law: Created by WeNeedaVacation.com. I believe the wastewater funds are actually needed to counteract the ravages of all of us who DONt use town water/septic, allowing our waste, nitrogen, etc. In fact, payments must either be by EFT (Electronic Funds Transfer) for free, or you will be charged a convenience fee if you opt instead to pay by credit card. The new law requires homeowners to maintain $1 million dollars in liability insurance to cover a rental home. Twelve? Check with your town for details. If you collect the funds for your rental, you will have to keep track of the tax, set it aside, and remit it to the state at a later date. How much is the tax?

DOR maintains a current listing of all local rates and fees, called the. Beginning July 1, 2019, for short-term rentals only, cities and towns are permitted to charge an additional community impact fee up to 3% if an operator has more than one property in that locality or is renting an owner-occupied 2 or 3 family house on a short-term rental basis. ) or https:// means youve safely connected to the official website. The state will retain its 5.7% and remit the balance to your town. How do you interpret that? Check with your insurance agent to be sure that you have adequate insurance coverage. tax lodging cod cape does If I have 15 family members and friends that come to my home each year and share expenses do I have to charge a meals tax on the lobsters that I pay for? Hi, Duane, Short term refers to any rental period of 31 days or less. c. 62C, 16B. This is why WeNeedaVacation.com has never been against THIS PART of the Lodging Tax bill. Short-Term Lodging Tax Percentage by Town, Joan Talmadge - My husband Jeff and I created WeNeedaVacation.com in 1997, shortly after buying our Cape home. New Advance Payment Requirement for Vendors and Operators in G.L. To register, go to this registration page. If I didnt have any taxable rentals during the previous month, do I still need to file with MassTaxConnect? On line 2, taxable rent, do not include exempt rent from pre-January 1, 2019contracts. Just wondering if when you say collecting the lodging tax as a separate fee that means that we need to request a separate payment from the renter for the amount of the taxes or if we can accept a single payment that includes both rental fees and tax? 8:30 a.m.4:00 p.m., Monday through Friday, Text of the law: Created by WeNeedaVacation.com. I believe the wastewater funds are actually needed to counteract the ravages of all of us who DONt use town water/septic, allowing our waste, nitrogen, etc. In fact, payments must either be by EFT (Electronic Funds Transfer) for free, or you will be charged a convenience fee if you opt instead to pay by credit card. The new law requires homeowners to maintain $1 million dollars in liability insurance to cover a rental home. Twelve? Check with your town for details. If you collect the funds for your rental, you will have to keep track of the tax, set it aside, and remit it to the state at a later date. How much is the tax?

Do Marthas Vineyard and Nantucket require collection of the Wastewater Tax? Or do you think the tax applies only to security deposits that arent returned after the stay because of damage? thanks Gordon, Hi, Gordon, if I understand you correctly, yes, you would need to register, even if you wont be renting any longer in the future. I get great joy from helping fellow homeowners successfully rent their homes. The other sites, and realtors as well, collect the funds as well as service fees from vacationers and are directly involved in the rental transactions. An operator is anyone operating a bed and breakfast establishment, hotel, lodging house, short-term rental or motel. The email I just received from We Need a Vacation. Lease contracts should include provisions that all state and local taxes and fees are due as of the date of occupancy, so occupants are aware that additional amounts may be due if rate or fee changes occur after a contract is signed. If you are unable to get the operators certificate number, you will need to include the operators Federal ID number or Social Security number on your return. We have been told by the DOR that there would be penalties for late filing and late payment of the tax, but they have not been specific. Generally, the room occupancy excise is collected and paid to DOR by a person or business called an operator. Check with local officials in the city or town in which the property is located to find out more. A short-term rental unit may be considered professionally managed for this purpose whether or not an intermediary is involved. occupancy Yes, Sandy, she would save quite a lot if she rented at least 32 days from you as she wouldnt have to pay any lodging tax at all. Visit, Division of Local Services Municipal Databank. Rents collected and reported by an intermediary are not considered exempt rents for the operator. If your guests are exempt from the Lodging Tax due to your only renting for 14 days or less per year, please let us know so that we can update your listing accordingly.

See below.

Hi, Chris, We do not provide $1 M insurance policy, and the primary reason is that we advertise and market the homes on our site but are not in any way involved in the actual financial and business end. An intermediary includes a broker, hosting platform, or operators agent. As an intermediary, the return must include each operators registration certificate numberorFederal ID [or Social Security Number], along with the name and address of the operator and the amount of taxes and fees collected. An official website of the Commonwealth of Massachusetts. No tax would be due for your long-term tenant, nor would you need to file a return for the months of the long-term tenancy. The law expands the states hotel and motel tax to include the short-term rental of homes and condos. The MA Department of Revenue offers a clear and helpful FAQs page with information about registering as an operator. (Note: that is what you are, an Operator.). If that exception applies to you, you must let us know at the time of registration that you will not be renting out your property for more than 14 days. falmouth rental vacation cod cape mile1 10min lounge yard walk town play What if a town increases its local excise rate or imposes a new fee? No, Ken, WeNeedaVacation.com is under no obligation to the Comm. We have updated our FAQs with this item: Do I need to register my home?

An operator is required to keep records relating to charges and receipts for all transfers of occupancy, as well as copies of returns filed.

The Insurance issue will be big for all owners. Thx. Thanks! What if a town increases its local excise rate or imposes a new fee? . Your short-term tenants would pay a tax, and you would remit the tax for those months.

The term rent includes all optional charges, including but not limited to insurance, linen fees, cleaning fees, and booking fees. Alodging house or establishment is where lodgings are rented to four or more persons unrelated to the operator. c. 62C, 16B, Register as an operator or intermediary with MassTaxConnect, An Act Regulating and Insuring Short-Term Rentals, Massachusetts Room Occupancy Excise (Regulation), TIR 19-3: Changes to the Room Occupancy Excise in An Act Regulating and Insuring Short-Term Rentals, Tourism Destination Marketing District (TDMD) Fund FAQs, FY2020 Short Term Rental Economic Activity Report, FY2021 Short Term Rental Economic Activity Report.

Operators may want to include provisions in lease contracts stating that all state and local taxes and fees are as of the date of occupancy so occupants will be prepared for possible increases due to rate or fee changes after a contract is signed. Which homes are subject to the Wastewater Tax? I only rent my Various sources, such as the city or town website and local media, may have information about upcoming votes. For all types of rental accommodations, if the total amount of rent is less than $15 per day, no tax is due. If you cant provide a tax return or refund amount, call the Trustee Tax Contact Center at (617) 887-6367 (choose #3 for Business tax, then #2 for Trustee Taxwhen prompted). Boston Office 617-722-1570, District Office508-237-7001. Without it, DOR may ask the intermediary to remove the property from their listings. It also does not include time-share property or bed and breakfast homes (see definition of bed and breakfast). Is it okay for me to share this blog with my renters? These policies are included with the rental and satisfy the law as I am being told.