SARS Tax Tables 2022/2022 | Beginners Tax Guide - SA Shares Income from R0.00. The three types of taxes that small businesses pay are turnover tax, employee taxes ( PAYE , UIF and SDL) and VAT (value-added tax). Tax Brackets South Africa Expat Tax, Explaining the New SARS Tax Law Changes Tax

SARS Tax Tables 2022/2022 | Beginners Tax Guide - SA Shares Income from R0.00. The three types of taxes that small businesses pay are turnover tax, employee taxes ( PAYE , UIF and SDL) and VAT (value-added tax). Tax Brackets South Africa Expat Tax, Explaining the New SARS Tax Law Changes Tax Monthly Tax Deduction Tables. Standard VAT or sales tax rate. 2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters. South Africa Residents Income Tax Tables in 2022: Income Tax Rates and Thresholds (Annual) Tax Rate. Taxable Income Threshold. 18%. Income from R0.00. to. R216,200.00. 26%. Income from R216,200.00. Income Tax Calculator 2022/2023 | South Africa - Old Mutual. Tax on column 1 (ZAR) Tax on excess (%) 0 to 226,000: 0: 18: 321 601 445 100. Africa Tax Taxable Income Threshold. The budget proposes the adjust personal income tax brackets by 4.5%. SARS Tax Table 2021 - South African Tax Consultants The income tax brackets in South Africa for the 2022 tax year (1 March 2021 to 28 February 2022) are as 10% if the non-resident seller is a company, or.

This page provides - South Africa Personal Income Tax Rate - actual values, historical data, forecast, chart, statistics, economic

South African Income Tax Rates from Tax Guide 2019/2020 | Tax Consulting South Africa

Search for: Menu. R14,958.00. Brazil Covid variant may be more contagious and spread easily, experts say. In summary, she pays R2,604 in tax on her ETH profit of R61,800. Income from R0.00.

Other employment tax deduction tables -No changes from last year. Taxable Income Tax Rate; R 0 - R 216 200: 18%: R 216 201 R 337 800: R 38 916 + (26% of amount above R 216 200) R 337 801 R 467 500: R 70 532 + (31% of amount above R 337 800) R 467 501 R 613 600: South Africa

293 601 406 400. South Africa | English.

SayPro South African Tax Bracket | SayPro South Africa 2019 Tax Tables for Interest and Dividends; R0.00: Interest Exemptions threshoold for an individual younger than 65: R0.00: Interest Exemptions threshoold for an individual 65 and older % Final Withholding tax charged on interest from a South African source payable to non-residents: R0.00: Dividends Tax: R0.00: Foreign Dividends: R0.00

SayPro South African Tax Bracket | SayPro South Africa 2019 Tax Tables for Interest and Dividends; R0.00: Interest Exemptions threshoold for an individual younger than 65: R0.00: Interest Exemptions threshoold for an individual 65 and older % Final Withholding tax charged on interest from a South African source payable to non-residents: R0.00: Dividends Tax: R0.00: Foreign Dividends: R0.00

R 115 762 + (36% of amount above R 488 700) Who is it for?R83 100 if you are younger than 65 years.If you are 65 years of age to below 75 years, the tax threshold (i.e. the amount above which income tax becomes payable) is R128 650.For taxpayers aged 75 years and older, this threshold is R143 850. Income from R216,200.00. ENSafrica Your LinkedIn Connections with the authors To print this article, all you need is to be registered or login on Mondaq.com. South Africa latest Income Tax Rates and Thresholds with Sal Earn under R500,000? 18% of taxable income. Search for ISBN 9781680922929. 18% of taxable income. 37 062 + 26% of taxable income above 205 900. 40680 + 26% of taxable income above 226000.

18% of taxable income. Tax R128 400 + 38% of amount above R484 000. South Africa: Africa Tax In Brief 27 July 2022 . Tax payer's update: Proposed tax brackets South Africa 2021 South Africa 2019 Tax Tables for Interest and Dividends; R0.00: Interest Exemptions threshoold for an individual younger than 65: R0.00: Interest Exemptions threshoold for an individual 65 and older % Final Withholding tax charged on interest from a South African source payable to non-residents: R0.00: Dividends Tax: R0.00: Foreign Dividends: R0.00 Turnover and shareholding conditions apply in respect of the small business corporation system. 91 251 365 000 7% of taxable income above 91 250. R532 041 + 45% of taxable income above R1 500 000. South Africa Residents Income Tax Earning Threshold in 2021: Income Tax Threshold amounts (Annual) Age Group. Salary. 18%.

A hardback color version is available. South African 37 062 + 26% of taxable income above 205 900. Secondary [65 to 75] R8,199.00. Recent developments .

tax brackets 2022 south africa calculator.

450 001 and above. Corporate tax in South Africa 18% of taxable income. General government revenue, in % of GDP, from VAT. South Africa Corporate Income Tax. 205 901 321 600. gdp capita

Individual Tax Rate Tables | TaxTim Blog SA Tax. 18% of taxable income. Search for ISBN 9781680922929. R131 125 + 40% of amount above R450 000. R216,200.00. 33 840 + 26% of taxable income above 188 000. If her marginal tax bracket rate is 31%, she will pay 31% of R8,400 which is R2,604. South Africa tax brackets indicate the different levy rates based on groups and ages. Tax on Bonus Payments: How Does it Work R708 310. 205 901 321 600. Bonus. tax chart sars income canada bracket table taxable tables South Africa - Corporate - Taxes on corporate income calculation liability salary calculator Income tax brackets in South Africa are progressive like elsewhere, where you pay a higher income tax rate the more you earn. 170734 + 39% of taxable income above 641400. For the latest tax developments relating to South Africa, see . Know what tax bracket you fall into in South Africa africans economists Tax Brackets 2022 South Africa Calculator. 26%. WHT on interest: 15% of the gross amount of interest. Value-added tax A company is resident in South Africa if it is incorporated, established, or formed in South Africa or has its place of effective management in South Africa. Year ending 28 February 2023. Value-added tax (VAT) in South Africa was set at a rate of 14% and remained unchanged since 1993. The National Treasury now estimates tax revenue for 2021/22 to be R1.55 trillion, he said. R321 601 R445 100. Income from R216,200.00. The income tax in brackets South Africa for 2019 (1 March 2018 28 February 2019) are listed below: Up to R195,850: 18% of taxable income. In terms of the residence basis of taxation, any person who is considered to be a South African tax resident will be subject to tax on worldwide income and capital gains. Tax Brackets 2022 South Africa Calculator. Treasury notes that the World Health Organisation believes that at least 70% of cigarette prices should be go towards government tax. 2021 (1 March 2020 28 February 2021) Weekly Tax Deduction Tables.

Openview is South Africa's first free HD satellite TV service, with 16 TV channels and 8 radio stations that offer endless, exciting [00007f2394c94890] avcodec decoder error: existing hardware acceleration cannot be reused libva info: VA-API version 1. Internet south africa present in South Africa for more than 183 days during the 12-month period preceding the date on which the interest is received or accrued, or the debt from which the interest arises is effectively connected to a permanent establishment (PE) of that person in South Africa. Income tax on rent, worked example, in South Africa. Income Tax Calculators treasury Heres who actually pays taxes in South Africa - BusinessTech Corporate tax rates in South Africa. SayPro south african tax bracket.

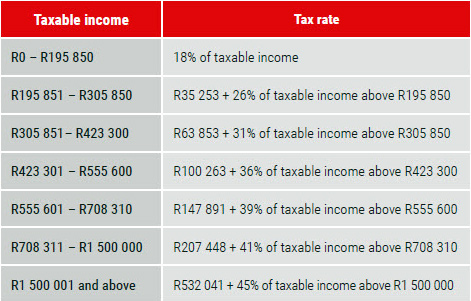

R147 891 + 39% of taxable income above R555 600. All Tax Calculators on iCalculator are updated with the latest Tax Rates Personal Allowances for the 2021/22 tax year. R205 901 R321 600. For enquiries regarding applications call UNISA on 012 429 6171 Free SARS Income Tax Calculator 2023 | TaxTim SA Find South African Tax Rates tables and related information. Taxation in South Africa - Wikipedia