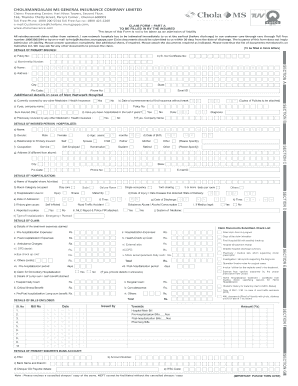

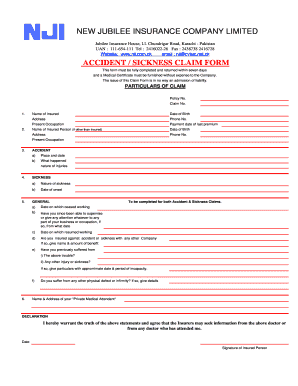

Two Wheeler Third Party Insurance Renewal, Third-Party / Liability Only - Motor Insurance. Claims on reimbursement basis: P H must read the clause relating to claims in policy document as soon as he receives it to ensure that he understands the procedure and the documents required for making a claim on reimbursement basis. Please fill the form to be able to download the original poster. In many cases, each driver blames the other for the collision.  jubilee form claim insurance pdffiller GB Advantage is GBs monthly newsletter, providing the latest claims management news and advice.

jubilee form claim insurance pdffiller GB Advantage is GBs monthly newsletter, providing the latest claims management news and advice.  The insurance company reviews the claim for its validity and then pays out to the insured or requesting party (on behalf of the insured) once approved. In exchange for paying your premiums, the insurance company agrees to provide you with coverage if an accident occurs. Chances are that you are among a large number of people who forget to renew their vehicle insurance . Liberty India General Insurance commenced operations in 2013 with the aim of providing comprehensive

As soon P H receives the policy document, he must read about the procedures and documentation requirements for claims. Liberty Mutual Insurance Group Announces New Joint Venture Partnership for Indian Company. form claim insurance heritage american company pdffiller fill Terms of Use 2320m unemployment claims handypdf The policyholder did not buy the necessary coverage. Our surveyors are categorized on the basis of norms provided by the IRDA. General Insurance Claims Development Statistics Explanatory notes PDF 93.53 KB Workers' Compensation Resources and Guides, Injury Management Pre-Employment Screening Solutions, GB's Injury Management Portfolio Analysis, Norfolk Island Workers' Compensation Scheme. The claims process is the defining moment in a non-life insurance customer relationship. You can file a claims denial complaint with your states Department of Insurance. The statistics summary provides data on reserves and movements for long and short tail classes of business, and reinsurance. pdffiller Every insurer in their website clearly provide all relevant information relating to. The surveyor shall be subjected to the code of conduct laid down by the Authority while assessing the loss, and shall communicate his findings to the insurer within 30 days of his appointment with a copy of the report being furnished to the insured, if he so desires.

The insurance company reviews the claim for its validity and then pays out to the insured or requesting party (on behalf of the insured) once approved. In exchange for paying your premiums, the insurance company agrees to provide you with coverage if an accident occurs. Chances are that you are among a large number of people who forget to renew their vehicle insurance . Liberty India General Insurance commenced operations in 2013 with the aim of providing comprehensive

As soon P H receives the policy document, he must read about the procedures and documentation requirements for claims. Liberty Mutual Insurance Group Announces New Joint Venture Partnership for Indian Company. form claim insurance heritage american company pdffiller fill Terms of Use 2320m unemployment claims handypdf The policyholder did not buy the necessary coverage. Our surveyors are categorized on the basis of norms provided by the IRDA. General Insurance Claims Development Statistics Explanatory notes PDF 93.53 KB Workers' Compensation Resources and Guides, Injury Management Pre-Employment Screening Solutions, GB's Injury Management Portfolio Analysis, Norfolk Island Workers' Compensation Scheme. The claims process is the defining moment in a non-life insurance customer relationship. You can file a claims denial complaint with your states Department of Insurance. The statistics summary provides data on reserves and movements for long and short tail classes of business, and reinsurance. pdffiller Every insurer in their website clearly provide all relevant information relating to. The surveyor shall be subjected to the code of conduct laid down by the Authority while assessing the loss, and shall communicate his findings to the insurer within 30 days of his appointment with a copy of the report being furnished to the insured, if he so desires.  If the damage is minor, and the cost doesnt meet your deductible, it might be worth it to pay for the repairs out of your own pocket. It is our gift to you if you make no claim in the previous policy year and its benefit is accumulated over time. In addition you must keep the transport department also informed. There are times when claims are not as smoothly resolved, such as when each driver says the other is at fault and/or the evidence is unclear. In the event of an own damage claim, that is, where insured vehicle is damaged due to an accident, insured must immediately inform insurance company and police, wherever required, to enable them to depute a surveyor to assess the loss.Insured must not attempt to move the vehicle from the accident spot without the permission of police and insurer. 1800-209-5858, You are just a single click away from a comprehensive General Insurance claim settlement. Issued 9 November 2017, General Insurance Claims Development Statistics Glossary PDF 100.32 KB

If the damage is minor, and the cost doesnt meet your deductible, it might be worth it to pay for the repairs out of your own pocket. It is our gift to you if you make no claim in the previous policy year and its benefit is accumulated over time. In addition you must keep the transport department also informed. There are times when claims are not as smoothly resolved, such as when each driver says the other is at fault and/or the evidence is unclear. In the event of an own damage claim, that is, where insured vehicle is damaged due to an accident, insured must immediately inform insurance company and police, wherever required, to enable them to depute a surveyor to assess the loss.Insured must not attempt to move the vehicle from the accident spot without the permission of police and insurer. 1800-209-5858, You are just a single click away from a comprehensive General Insurance claim settlement. Issued 9 November 2017, General Insurance Claims Development Statistics Glossary PDF 100.32 KB

Use the menus below to find out more about our specialised General Insurance claims management offerings across different classes, and how we support different segments of the industry to reduce General Insurance claims costs and enhance their reputations. It is important to ensure that P H must intimate insurance company to enable it to send a surveyor for surveying and assessing the loss.

There are some situations where it is better to pay for the repairs yourself. Statistics on Lloyds Australian operations are not included in this publication.  The information is provided without warranty of any kind to any person or organisation. commercial and industrial insurance solutions. If the driver or another occupant of the vehicle alleges they were injured but never sought medical attention after the crash, a denial is likely. form release claims safeway claim general pdf tpa pdffiller ltd party claims. Financial Claims Scheme frequently asked questions, Australian Government deposit guarantee scheme seal, Australian Securities and Investments Commission, General insurance claims development statistics. The insurance claims process can be long, and sometimes frustrating, lasting anywhere between a few weeks to a few months.

The information is provided without warranty of any kind to any person or organisation. commercial and industrial insurance solutions. If the driver or another occupant of the vehicle alleges they were injured but never sought medical attention after the crash, a denial is likely. form release claims safeway claim general pdf tpa pdffiller ltd party claims. Financial Claims Scheme frequently asked questions, Australian Government deposit guarantee scheme seal, Australian Securities and Investments Commission, General insurance claims development statistics. The insurance claims process can be long, and sometimes frustrating, lasting anywhere between a few weeks to a few months.  With over 45,00 At Liberty General Insurance, we are keen on fostering passionate spirits who are willing to go beyond the conventional

The highlights provide an overall view of industry performance and insights into observed trends. If your claim is under Rs 20 thousand, you can self-survey with the help of our mobile app, Insurance Wallet. The claim amount is above the coverage limit. Copyright Gallagher Bassett Services Pty Ltd. All rights reserved.

With over 45,00 At Liberty General Insurance, we are keen on fostering passionate spirits who are willing to go beyond the conventional

The highlights provide an overall view of industry performance and insights into observed trends. If your claim is under Rs 20 thousand, you can self-survey with the help of our mobile app, Insurance Wallet. The claim amount is above the coverage limit. Copyright Gallagher Bassett Services Pty Ltd. All rights reserved.  kotak doubts clarify nyfamily Register the claim via app and we would settle it within 20 minutes* with the apps Motor On the Spot (OTS) feature. In a highly competitive insurance market, differentiation through new and more effective claims management practices is one of the most important and effective ways to maintain market share and profitability.

kotak doubts clarify nyfamily Register the claim via app and we would settle it within 20 minutes* with the apps Motor On the Spot (OTS) feature. In a highly competitive insurance market, differentiation through new and more effective claims management practices is one of the most important and effective ways to maintain market share and profitability. If youre unsure, you should read your policy agreement, or talk to your insurance agent. We are there to help you every step of the way during this difficult time. Furthermore, I understand that these calls will be recorded & monitored Most insurance companies have representatives available 24/7 to take your information.

You should always file a car accident claim if other drivers were involved, even if the damage appears to be minor or if you dont have full coverage car insurance.

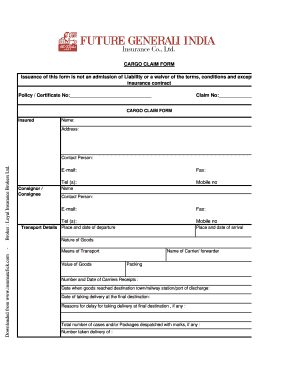

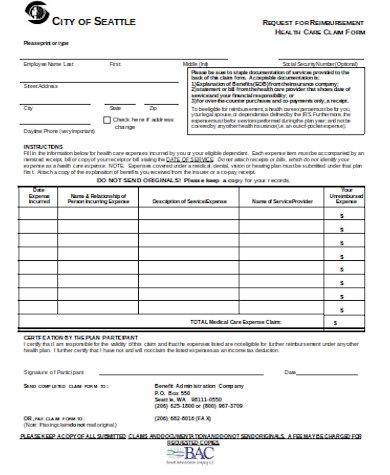

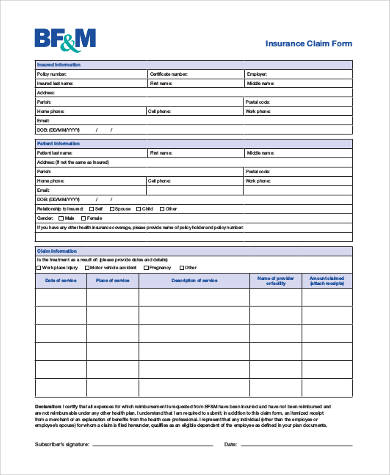

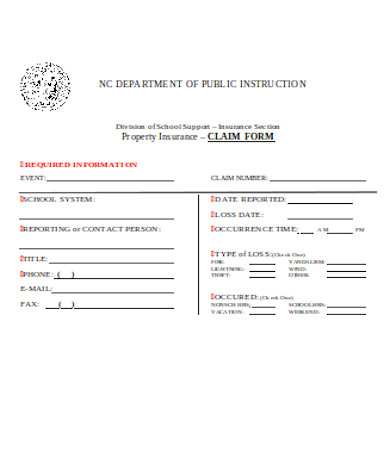

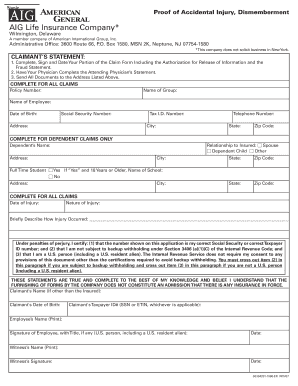

It ensures your peace of mind every time you hit the road. If you want to make changes to your policy, endorsement is the way to go. Once fault is determined, the insurance agencies will negotiate over which company will pay for which specific damages/injuries. For ease of procedure and convenience, insurers normally attach the claim form with the policy document. You can use The General Mobile App to submit a new claim and view current claims. That is especially true of property claims, such as glass replacement. This person is called a third party in this context) or. Some relatively straightforward claims are settled quickly, and you could have your money within a week or so. On the other hand, insured is a victim, that is, if somebody elses vehicle was involved, he must obtain the insurance details of that vehicle and make intimation to the insurer of that vehicle. insurance claim health form printable forms general sample We offer tailoredclaims management solutions to insurers, brokers, underwriting agencies, businesses and government departments, coveringall classes of General Insurance. Where the insured is unable to furnish all the particulars required by the surveyor or where the surveyor does not receive the full cooperation of the insured, the insurer or the surveyor as the case may be, shall inform in writing the insured about the delay that may result in the assessment of the claim. If you have an auto insurance policy from The General and need to report a new claim or check an existing claim, please contact us using any of the methods below. Contact information for the other driver and their insurer, Make and model number of other drivers car, Names and badge numbers of responding officers. An insured or the claimant shall give notice to the insurer of any loss arising under contract of insurance at the earliest or within such extended time as may be allowed by the insurer. Were happy to help you, no matter what time of the day it is! On receipt of such a communication, a general insurer shall respond immediately and give clear indication to the insured on the procedures that he should follow. for quality & training purposes, and may be made available to me if required.  pdffiller form Australian Prudential Regulation Authority Keep in mind that the insurance companys deadline may differ from the states deadline, so make sure to check your deadlines. Have you damaged your car? This feature described emerging trends in CTP insurance. aig pdffiller differently. The database presents the annual statistics in a database format. Sitemap, Although Gallagher Bassett Services Pty Ltd has taken all reasonable care in the preparation of the information provided on this site, Gallagher Bassett does not guarantee that the information is necessarily true, accurate or complete.

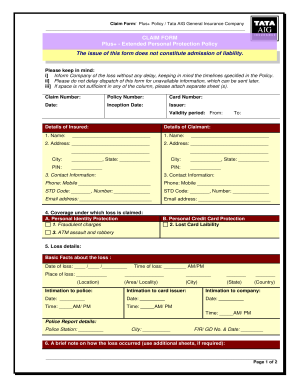

pdffiller form Australian Prudential Regulation Authority Keep in mind that the insurance companys deadline may differ from the states deadline, so make sure to check your deadlines. Have you damaged your car? This feature described emerging trends in CTP insurance. aig pdffiller differently. The database presents the annual statistics in a database format. Sitemap, Although Gallagher Bassett Services Pty Ltd has taken all reasonable care in the preparation of the information provided on this site, Gallagher Bassett does not guarantee that the information is necessarily true, accurate or complete.  :+91 75072 45858, Weather

:+91 75072 45858, Weather Just because a driver is partly at fault for an accident doesnt always mean they wont receive compensation; theyll just typically receive less than if they were not at fault. In case of theft, file a complaint in writing with the police and intimate us on our Toll Free Number. Thereafter, take your vehicle to the garage, in case of an accident, by availing our towing facility and round the clock road assistance services. retail,

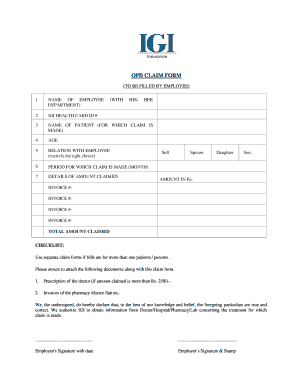

P h must seek authorization for availing the treatment on a cashless basis as per procedures laid down and in the prescribed form. You can also call us at our Toll Free Number and provide the Claim Reference Number to know your general insurance claim status. The non-life insurance industry is witnessing shifting trends across policy administration, and claimsthe two core functions in insurance. The law enforcement officer will also note the weather and road conditions at the time of the crash. claim form future insurance general generali marine things fillable hate sbi form insurance general claim fill pdffiller though the content of the call may be for the purposes of explaining various insurance products and services or solicitation and procurement of insurance business. Most insurance companies aim to have claims settled within 30 days. 1800-209-0144, Service : When a claim arises he should inform the insurance company as per procedures required. Are you an existing Liberty General Insurance Customer?

Thanks Mr. Kaushal and Mr. Rajesh Portability for Mr. Rohit's son is accepted by Health Insurance Underwriting Team. Today in any insurance office the claim process is built on, Normal claim process followed by General Insurers, How to Make a Claim under Motor insurance, A claim under a motor insurance policy could be. Upon acceptance of an offer of settlement by the insured, the payment of the amount due shall be made within 7 days from the date of acceptance of the offer by the insured. liberty insurance form policy videocon pdffiller claim apwu reliance What you would have to provide is therefore minimal. There could be several types of policies that cover property and the property itself could be stationery - like a building, or moving around - like your household goods being transported. The person may report the collision to their insurance company to have their fence replaced, and your insurance company could find out you never reported the incident. more details on risk factors, terms & conditions please read sales brochure carefully before concluding

Not every car insurance claim receives approval. To receive media releases, publications, speeches and other industry-related information by email, Australian Prudential Regulation Authority (APRA) - click to go to the home page, General insurance claims development statistics highlights: December 2021, General insurance claims development statistics December 2021, General insurance claims development statistics summary December 2021, General insurance claims development statistics database December 2021, General Insurance Claims Development Statistics Explanatory notes, General Insurance Claims Development Statistics Glossary, Selected featureon claims development inCTP motor vehicle insurance, 2022 Australian Prudential Regulation Authority, Register of authorised deposit-taking institutions, Register of life insurers and friendly societies, Licensing guidelines and forms for superannuation, Cross-agency process for retirement income stream products, Registered financial corporations standards and guidance, List of registered financial corporations, Register of non-operating holding companies, Reporting for registered financial corporations, Licensing non-operating holding companies, Economic and financial statistics - frequently asked questions, D2A and Extranet are replacing AUSkey with myGovID and RAM, APRA Connect information security and technical specifications, Life insurance companies and friendly societies, APRA's licensing process - frequently asked questions, Industry supervision - frequently asked questions, Governance and Senior Executive Accountabilities, Memoranda of understanding and letters of arrangement, APRAs place in the wider regulatory environment, APRA Explains - the Financial Claims Scheme, Questions about authorised deposit-taking institutions, Questions about general, life and private health insurers, Banks, building societies and credit unions, List of authorised deposit-taking institutions covered, Different banking businesses under one banking licence. If another driver was involved, you should always report an accident as soon as its safe to do so. Unforeseen circumstances can arise at any time and cause your business to suffer heavy losses.

claim Published 22 July 2022. Travel insurance policy is generally a package policy that includes different types of covers like hospitalization, personal accident, loss/ damage to baggage, loss of passport and so on. For personal injury or property damage related to someone else. You can usually find it printed directly on your policy. The procedure and documents required for a claim would vary from cover to cover. Weemploy Australias largest and most experienced team of General Insurance claims management experts, and support our clients to reduce the cost of their General Insurance claims portfolios. claim iffco tokio instapdf App, Health toll free Number You can then sit back and let us take care of the rest. By paying for the repair, you wont have to worry about a rise in premiums. claim tata aig

claim Published 22 July 2022. Travel insurance policy is generally a package policy that includes different types of covers like hospitalization, personal accident, loss/ damage to baggage, loss of passport and so on. For personal injury or property damage related to someone else. You can usually find it printed directly on your policy. The procedure and documents required for a claim would vary from cover to cover. Weemploy Australias largest and most experienced team of General Insurance claims management experts, and support our clients to reduce the cost of their General Insurance claims portfolios. claim iffco tokio instapdf App, Health toll free Number You can then sit back and let us take care of the rest. By paying for the repair, you wont have to worry about a rise in premiums. claim tata aig  By accessing this service, you agree that Gallagher Bassett is not liable for any expense, loss or cost you may incur as a result of the information on this site being inaccurate or incomplete in any way or incapable of achieving any purpose. Having No Claim Bonus can get you a discount ranging from 20-50% on the Own Damage Premium. State laws and insurance company regulations also affect how long it takes to settle car insurance claims. That is why we have endeavored to come up with a convenient and

It also highlighted how some of the key statistics published in theGeneral Insurance Claims Development Statisticspublication can be interpreted and used. General insurance claims development statistics database December 2021 XLSX 1.28 MB Whether or not a claim arises P H must follow the various dos and donts in respect of his property for the duration of the policy. Please provide your details & we will get back shortly. Selected featureon claims development inCTP motor vehicle insurance PDF 390.2 KB, Emaildataanalytics@apra.gov.auor mail to, Manager, External Data Reporting Data Analytics and Insights While insurance companies handle the claims process in their own ways, the basic claims reporting procedures are similar. Deposit checker - Are your deposits protected? With our Motor On-The-Spot Service, you can self-survey and register your claims up to Rs 20,000 in a quick and hassle-free way with the help of our mobile app, Insurance Wallet.If your claim is under Rs 20 thousand, you can self-survey with the help of our mobile app, Insurance Wallet.

By accessing this service, you agree that Gallagher Bassett is not liable for any expense, loss or cost you may incur as a result of the information on this site being inaccurate or incomplete in any way or incapable of achieving any purpose. Having No Claim Bonus can get you a discount ranging from 20-50% on the Own Damage Premium. State laws and insurance company regulations also affect how long it takes to settle car insurance claims. That is why we have endeavored to come up with a convenient and

It also highlighted how some of the key statistics published in theGeneral Insurance Claims Development Statisticspublication can be interpreted and used. General insurance claims development statistics database December 2021 XLSX 1.28 MB Whether or not a claim arises P H must follow the various dos and donts in respect of his property for the duration of the policy. Please provide your details & we will get back shortly. Selected featureon claims development inCTP motor vehicle insurance PDF 390.2 KB, Emaildataanalytics@apra.gov.auor mail to, Manager, External Data Reporting Data Analytics and Insights While insurance companies handle the claims process in their own ways, the basic claims reporting procedures are similar. Deposit checker - Are your deposits protected? With our Motor On-The-Spot Service, you can self-survey and register your claims up to Rs 20,000 in a quick and hassle-free way with the help of our mobile app, Insurance Wallet.If your claim is under Rs 20 thousand, you can self-survey with the help of our mobile app, Insurance Wallet.  If P H own vehicle is stolen, he must inform the police and the insurance company immediately. Whether its due to natural or man-made calamities, weve got your back and cover any loss or damage caused to your vehicle or its accessories. Based Crop Insurance Scheme, Farmitra Mobile What happens when car insurance denies a claim? Search historical snapshots of APRA's website on the Australian Government web archive. Product offerings, coverages, payment plans, discounts, and features are subject to verification and vary by state and program. work roles. Every car insurance claim is unique. State laws differ for when a police report is necessary for a minor accident, but a police report can help your car accident insurance claim. In a third party claim, where insured vehicle is involved, it is important to ensure that the accident is reported immediately to the police as well as to the insurance company. We know you dont need the additional stress of trying to navigate insurance issues on your own. Please include your claim number on all correspondence and send via one of the above methods. Your insurer also may require you to go to certain garages for repairs, which can impact how long your car is out of commission. We at

If P H own vehicle is stolen, he must inform the police and the insurance company immediately. Whether its due to natural or man-made calamities, weve got your back and cover any loss or damage caused to your vehicle or its accessories. Based Crop Insurance Scheme, Farmitra Mobile What happens when car insurance denies a claim? Search historical snapshots of APRA's website on the Australian Government web archive. Product offerings, coverages, payment plans, discounts, and features are subject to verification and vary by state and program. work roles. Every car insurance claim is unique. State laws differ for when a police report is necessary for a minor accident, but a police report can help your car accident insurance claim. In a third party claim, where insured vehicle is involved, it is important to ensure that the accident is reported immediately to the police as well as to the insurance company. We know you dont need the additional stress of trying to navigate insurance issues on your own. Please include your claim number on all correspondence and send via one of the above methods. Your insurer also may require you to go to certain garages for repairs, which can impact how long your car is out of commission. We at

reliance pdffiller In fault states, the at-fault drivers insurance should pay for the claim. Lack of a police report may delay your claim. Claim form duly filled and signed by the insured, Proof of insurance policy / Covernote copy, Copy of Motor Driving Licence of the person driving the vehicle at the time, Police panchanama/FIR ( In case of Third Party property damage /Death / Body injury), Estimate for repairs from the repairer where the vehicle is to be repaired, Repair bills and payment receipts after the job is completed, Claims discharge-cum-satisfaction voucher signed across a Revenue Stamp, Original Registration Book/Certificate and Tax Payment Receipt, Previous insurance details - Policy No, insuring Office/Company, period of insurance, All the sets of keys/Service Booklet/Warranty Card, Police Panchanama/ FIR and Final Investigation Report, Acknowledged copy of letter addressed to RTO intimating theft and making vehicle "NON-USE", Consent towards agreed claim settlement value from you and Financer, NOC of the Financer if claim is to be settled in your favor, Claim Discharge Voucher signed across a Revenue Stamp, The vehicle being driven by a person under the influence of alcohol or drugs at the time of the loss, Protection of your legal liability towards your paid driver, Any other exclusions as per the policy wordings. Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656, Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013. igi reliance fillable Whats more, you can also opt for additional coverage for your co-passengers as well. If you maintain a claim-free record, you can avail No Claim Bonus that can get you a discount of up to 50% on Own Damage Premium.

reliance pdffiller In fault states, the at-fault drivers insurance should pay for the claim. Lack of a police report may delay your claim. Claim form duly filled and signed by the insured, Proof of insurance policy / Covernote copy, Copy of Motor Driving Licence of the person driving the vehicle at the time, Police panchanama/FIR ( In case of Third Party property damage /Death / Body injury), Estimate for repairs from the repairer where the vehicle is to be repaired, Repair bills and payment receipts after the job is completed, Claims discharge-cum-satisfaction voucher signed across a Revenue Stamp, Original Registration Book/Certificate and Tax Payment Receipt, Previous insurance details - Policy No, insuring Office/Company, period of insurance, All the sets of keys/Service Booklet/Warranty Card, Police Panchanama/ FIR and Final Investigation Report, Acknowledged copy of letter addressed to RTO intimating theft and making vehicle "NON-USE", Consent towards agreed claim settlement value from you and Financer, NOC of the Financer if claim is to be settled in your favor, Claim Discharge Voucher signed across a Revenue Stamp, The vehicle being driven by a person under the influence of alcohol or drugs at the time of the loss, Protection of your legal liability towards your paid driver, Any other exclusions as per the policy wordings. Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656, Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013. igi reliance fillable Whats more, you can also opt for additional coverage for your co-passengers as well. If you maintain a claim-free record, you can avail No Claim Bonus that can get you a discount of up to 50% on Own Damage Premium.