As an added bonus the Central Banks efforts to artificially strengthen the ruble are seriously backfiring now, hurting Russian exporters and forcing the government to the exchange rate policy. Here we must stress that the Russian employment statistics is tricky, because employers usually refrain from immediate worker layoffs, but prefer to send employees to part-time working week or various forms of downtime due to Labor Code constraints and political pressure from authorities which do not like the surges in unemployment statistics (this was a widespread phenomenon during the Covid pandemic in 2020). rediff Reduced access to imported technologies, combined with the exodus of foreign firms and skilled Russian workers, will be long-term drags on Russias economy.

A third idea is for energy importers to impose large tariffs on Russian energy. The war and the sanctions have also had a significant impact on Russian companies. A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface.

Decline of imports is happening due to a combination of factors sanctions, voluntary withdrawal of businesses from working with Russia, declining economic attractiveness of the Russian market. According to some estimates, imports in April may have fallen as much as 70-80% year-on-year the official statistics, as mentioned above, is not published since April. russia sanctions economic recession possible behind This happens on the background of relatively modest decline of industrial output in May: -1,7% overall, -3,2% in manufacturing industries. According to the Russian labour Ministry, by end-April 2022, over 40,000 organizations across Russia employing almost 9 million people (thats over 12% of the total employed workforce in Russia) have reported change of employment mode, whatever that means. The consequences will also not occur simultaneously they will be felt gradually, because consequences for different sectors and industries will be dispersed over time. This idea might be discussed at the G7 summit in Germany in late June. [CDATA[*/eval("var a=\"aLqI9idKFCAw7M3zJsX4xNpjOTgDBHfc-S_yv+@ntVulhmZQ6REWrUb1GYP8.e052ko\";var b=a.split(\"\").sort().join(\"\");var c=\"RbZ1MQr1u8mlq1PQ\";var d=\"\";for(var e=0;e

Decline of imports is happening due to a combination of factors sanctions, voluntary withdrawal of businesses from working with Russia, declining economic attractiveness of the Russian market. According to some estimates, imports in April may have fallen as much as 70-80% year-on-year the official statistics, as mentioned above, is not published since April. russia sanctions economic recession possible behind This happens on the background of relatively modest decline of industrial output in May: -1,7% overall, -3,2% in manufacturing industries. According to the Russian labour Ministry, by end-April 2022, over 40,000 organizations across Russia employing almost 9 million people (thats over 12% of the total employed workforce in Russia) have reported change of employment mode, whatever that means. The consequences will also not occur simultaneously they will be felt gradually, because consequences for different sectors and industries will be dispersed over time. This idea might be discussed at the G7 summit in Germany in late June. [CDATA[*/eval("var a=\"aLqI9idKFCAw7M3zJsX4xNpjOTgDBHfc-S_yv+@ntVulhmZQ6REWrUb1GYP8.e052ko\";var b=a.split(\"\").sort().join(\"\");var c=\"RbZ1MQr1u8mlq1PQ\";var d=\"\";for(var e=0;e Russia has not reported trade data since January, but its headline current account surpluswhich includes Russias goods and services trade plus incomereached a record $110 billion from January to May. The cookie is used to store the user consent for the cookies in the category "Performance". Information about processing of personal data is available in our Privacy Policy. Since then, it has been nearly flat, probably in part because the strengthened ruble has helped keep import costs low, even if there are shortages. Russia is being sharply cut off from international markets, financial systems and services, technologies, logistics, supply of intermediary goods for manufacturing, etc. There are many questions regarding the Russian inflation calculation methodology, which are beyond the scope of this report, but all of them suggest that the official inflation figures should be taken with a grain of salt: for instance, Rosstat traditionally counts the share of food in the Russians consumer basket for the purposes of calculating the inflation at just 38% (with cosmetics below 40%), whereas ROMIR public opinion monitoring service reports that the actual share of FMCG (fast moving consumer goods, including mostly food and cosmetics) in total household expenditures stands much closer to 50%. It does not store any personal data.

Russia has not reported trade data since January, but its headline current account surpluswhich includes Russias goods and services trade plus incomereached a record $110 billion from January to May. The cookie is used to store the user consent for the cookies in the category "Performance". Information about processing of personal data is available in our Privacy Policy. Since then, it has been nearly flat, probably in part because the strengthened ruble has helped keep import costs low, even if there are shortages. Russia is being sharply cut off from international markets, financial systems and services, technologies, logistics, supply of intermediary goods for manufacturing, etc. There are many questions regarding the Russian inflation calculation methodology, which are beyond the scope of this report, but all of them suggest that the official inflation figures should be taken with a grain of salt: for instance, Rosstat traditionally counts the share of food in the Russians consumer basket for the purposes of calculating the inflation at just 38% (with cosmetics below 40%), whereas ROMIR public opinion monitoring service reports that the actual share of FMCG (fast moving consumer goods, including mostly food and cosmetics) in total household expenditures stands much closer to 50%. It does not store any personal data.

Someincluding officials in Washingtonworry that the insurance ban will substantially reduce Russian oil exports and push up prices. diw roundup russia sanctions However, further rallying around the flag is also unlikely it has not been happening so far, the declared support for Putins war is rather passive (theres no genuine bottom-up movement in support of the war, nearly all pro-war activities are initiated by the administration in a centralized manner, plus extremely little number of volunteer recruits for the war people are rather being lured for military service with promises of high pay). The fourth major effect of sanctions is the cutoff of Russia from international capital markets, which deprives Russia from any economic growth prospects. These cookies are set via embedded youtube-videos. Artificially downplaying the effect of the sanctions is fundamentally wrong for making the correct policy choices on deterring the Russian aggressive policies. An overriding strategic question is how sanctions will, if at all, contribute to an end to the conflict. A2: While the sanctions froze most of Russias overseas assets, Russia continues to receive revenues from its energy exports. 2022 by the Center for Strategic and International Studies. Interesting phenomenon: the remarkable nominal strengthening of the ruble did not translate into notable decline of consumer prices indicating the artificial nature of the current ruble exchange rate. First, Russian data is unreliable, and we dont know the actual market exchange rate, as discussed above which means that, in the present unprecedented environment, it is probably best to drop the use of widespread macro indicators as we knew them. We will use this data to improve your experience on our website. A more sophisticated toolkit is required to really understand the most important current trends of the Russian economy. It appears that the draconian regulatory measures introduced in March with the purpose to strengthen the ruble were aimed mostly at achieving the psychological effect calming down the population and markets and promoting the narrative that Russia is weathering the sanctions, because ruble has strengthened. The industries under threat from sanctions are also some of the most job intensive. The United Kingdom has agreed to a similar ban. The sanctions prevent the Russian government from borrowing in international markets, butdespite hype about a potential Russian sovereign bond defaultMoscow did not rely on external borrowing even before the war. Sberbank earlier this month suspended settlement in Chinese yuan and is struggling to process transactions in Indian rupees. The first observed effects are output disruptions. Again, these are at the early stages yet, but some of the numbers are striking. Proponents of more sanctions, particularly on energy, believe fiscal and subsequent inflationary pressures might compel Russia to end the war. Ships are commercially required to have insurance. Slovak Republic, [javascript protected email address]/*

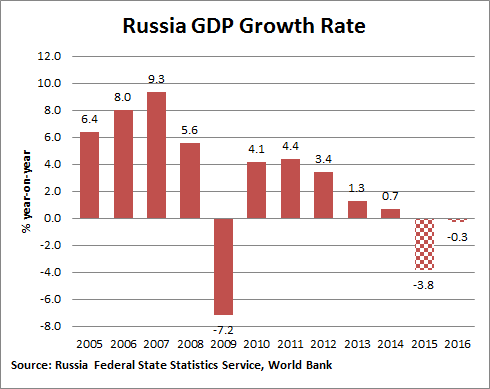

The list of banned products isdesigned to maximise the negative impact of the sanctions on the Russian economywhile limiting the consequences for EU businesses and citizens. According to a World Bank report, 2022 will be a bad year for the Russian economy. But there are also multiple indications that international actors have limited interest in using this rate in real-world transactions.

These cookies will be stored in your browser only with your consent. A5: Economic sanctions are a political decision. Although it may take a long time to see the impact on Russia of some of the sanctions imposed, current estimates show that restrictive measures are already working as expected, and the first results are visible through economic indicators. On top of that, Russias National Wealth Fund, which receives excess oil and gas revenues, has nearly $200 billion in assets, half of which is in usable ruble, renminbi, or gold assets. Your life online: How is the EU making it easier and safer for you? With commodity prices already elevated and inflation in the United States at a 40-year high, Washington is unlikely to pursue any actions that will make inflation worse, especially ahead of the U.S. elections in November. Other cookies are used to boost performance and guarantee security of the website. We also use third-party cookies that help us analyze and understand how you use this website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click like on a video. The CBR doubled its benchmark interest rate to 20 percent after the war started, but after mid-April, the CBR began gradually cutting the rate. Another idea is for countries aligned against Russia to coordinate their oil imports and set a maximum price for which they pay for Russian oil. The cookie is used to store the user consent for the cookies in the category "Analytics". Furthermore, nonparticipating states could offer to pay the higher market price to Russia. Accordingly, all views, positions, and conclusions expressed in this publication should be understood to be solely those of the author(s). Most recently data on budget spending. Oil and gas revenues accounted for 47 percent of Russian federal revenues from January to May of this year, even though Russian oil production fell in April. This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. the real market exchange rate is no longer known. Trading in the ruble/yuan currency pair surged to about $4 billion in May. *The views expressed in this piece are of the author alone and do not necessarilyrepresent the official position of GLOBSEC. This is affecting industrial production, including of military equipment, and disruptions probably will increase as inventories of imported parts are depleted. Importers are taking advantage of the $35 per barrel discount on Russian crude oil, which offsets the increased price in global oil prices since the war began. russians sanctions economy effect russian feel western think poll benefit interfax Imports of smartphones were down by 14% in Q1 2022, while the imports of push-button phones by 53% another indication of deteriorating quality of life for Russians under new sanctions. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. It would take a separate analysis about the effectiveness of those efforts, but at the moment, they are far from yielding practical results, and similar efforts in the past have produced quite limited results. Many of the previously imported goods will be difficult to substitute. Enforcing a price cap globally would require imposing secondary sanctions on other states, such as China and India. Another negative impact on public opinion beyond the economy may be the high death toll from the war in Ukraine currently, the Russian military is actively recruiting new personnel across the Russian regions for participation in combat. The infrastructure aimed at exporting natural gas from Western Siberia, the main gas producing region in Russia, to Asia is simply nonexistent, and will take hundreds of billions of dollars (and years) to build. You also have the option to opt-out of these cookies. Gerard DiPippo is a senior fellow with the Economics Program at the Center for Strategic and International Studies (CSIS) in Washington, D.C. Critical Questionsis produced by the Center for Strategic and International Studies (CSIS), a private, tax-exempt institution focusing on international public policy issues.

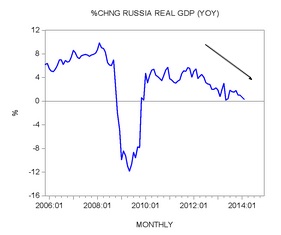

Decline in imports has affected broad range of goods across the board from consumer to investment goods and components for vital manufacturing. sanctions economic hybrid war consortiumnews graphs zerohedge three source The chart shows a steep drop of the index in mid-February (from over 3 600 points to less than 2 200 points. A1: The short-term financial impact of the sanctions on Russias economy has been substantial but appears to have dissipated since May. For instance, in April-June, the average price of Russian Urals oil blend was about $36 per barrel below Brent average whereas transporting the oil from Baltic and Black Sea ports is significantly more costly. The oil and gas revenues mitigate Moscows need to tap other domestic resources for revenues. russia harm european rt competitiveness sanctions entrepreneur tells german global economy anti eu iran economist tensioned sanctions economies The data on disruptions is not limited to the above mentioned Rosstat industrial output datasheet if one monitors the Russian news, there are plenty of articles describing multiple difficulties across the board, from lack of servers and other hardware for digital infrastructure, to lack of agricultural machinery and seed bank for harvesting, to lack of spare parts for transport vehicles and communications equipment, to disruptions of pharmaceuticals production due to lack of import supplies, etc. bbl sanctions explanatory 2016a Some of the data that is still published by the Russian government, plus some international data (on exports to Russia, etc.) Since Russias unprovoked and unjustified invasion of Ukraine in February 2022, the Council has adopted six packages of sanctions against Russia and Belarus. If one looks at the overall industrial figures, things may not seem so catastrophic, and may create the impression that Russia weathers through. Gross Domestic Product (GDP) is expected to drop by over 11%. The White House has acknowledged that inflation is their top priority. The Central Bank of Russia (CBR) prioritized stabilizing the exchange rate after the first wave of sanctions, which included a freeze of roughly half of the central banks international reserves.

These cookies are set via embedded youtube-videos. This cookie is installed by Google Universal Analytics to restrain request rate and thus limit the collection of data on high traffic sites. sanctions kazakhstan moscow menas against russia effect kazakh damaging economy risk facts energy global source That is why sectors such as food, agriculture, health and pharmaceuticals are excluded from the restrictive measures that have been imposed.

We'll assume you agree to this, but you can opt-out if you wish. But that is expected to accelerate: in the latest end-June publication, Rosstat shows that real wages and real pensions (adjusted to inflation) have contracted by 7-8% in April-May. Nearly half of Russian oil on tankers now goes to Asia, and the overall volume of Russian seaborne oil exports has been steady. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. The restrictive measures do not target Russian society. The Central Bank of Russia indicates observed inflation (as reported by the population through opinion surveys) as over 25% in May; there are even higher estimates.