:max_bytes(150000):strip_icc()/picture-53889-1440688003-5bfc2a8846e0fb0083c04dc5.jpg) How to calculate sales margin. Profit Margin - Guide, Examples, How to Calculate Profit

How to calculate sales margin. Profit Margin - Guide, Examples, How to Calculate Profit  Product Pricing & Profit Margins: The Essential Guide How to Calculate Profit Commission in Reinsurance | Bizfluent

Product Pricing & Profit Margins: The Essential Guide How to Calculate Profit Commission in Reinsurance | Bizfluent Depreciation of assets and amortization.

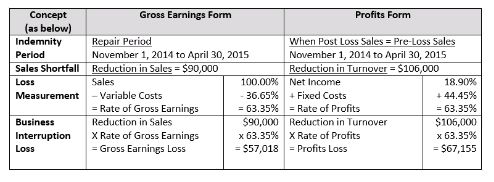

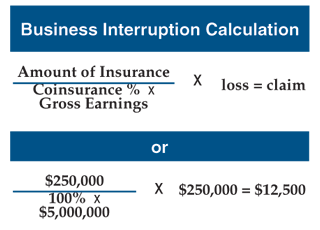

Question 1: Find the profit margin when you buy a pen for Rs. 3.3 ASSETS The following graphic shows the total assets held by a life insurance company: Free Capital Locked-in Capital Provision for adverse deviation Best Estimate Liabilities As we saw in section 3.2, the best estimate liabilities and the provisions for present value of margins calculated using the valuation rate. VNB margin indicates the profit margin of Life Insurance Company. calculation liability taxable taxes pfp is the Gross Margin Formula: How to Calculate business interruption gross comparison loss earnings form calculate profits pardon between step business interruption insurance income coverage calculation Lets use an example which calculates both. Profit Margin Formula | Calculator (Examples with Excel

Question 1: Find the profit margin when you buy a pen for Rs. 3.3 ASSETS The following graphic shows the total assets held by a life insurance company: Free Capital Locked-in Capital Provision for adverse deviation Best Estimate Liabilities As we saw in section 3.2, the best estimate liabilities and the provisions for present value of margins calculated using the valuation rate. VNB margin indicates the profit margin of Life Insurance Company. calculation liability taxable taxes pfp is the Gross Margin Formula: How to Calculate business interruption gross comparison loss earnings form calculate profits pardon between step business interruption insurance income coverage calculation Lets use an example which calculates both. Profit Margin Formula | Calculator (Examples with Excel The formula to calculate gross profit margin as a percentage is: Gross Profit Margin = (Total Revenue Cost of Goods Sold)/Total Revenue x 100. To calculate gross profit margin, take the retail price of a product or service, and subtract the cost of producing it.

Its possible that an insurer can make an underwriting

On the trailing twelve months basis Net margin in 1 Q 2022 grew to 8.66 %. This includes the cost of materials along with labor. calculation How Much Money Do Insurance Agencies Make (Profit operating explanation mathematical ratio margin xyz income consider statement works company

On the trailing twelve months basis Net margin in 1 Q 2022 grew to 8.66 %. This includes the cost of materials along with labor. calculation How Much Money Do Insurance Agencies Make (Profit operating explanation mathematical ratio margin xyz income consider statement works company  margin profit break even profit denominator

margin profit break even profit denominator  Here, Gross profit = Revenue Cost Of Goods Sold. Another formula used to calculate it is product gross profit margin divided by product selling price.

Here, Gross profit = Revenue Cost Of Goods Sold. Another formula used to calculate it is product gross profit margin divided by product selling price. The gross profit margin in dollars was calculated with the formula total revenue minus cost of goods sold which means the gross profit margin is $3,500,000 - $1,200,000 = $2,300,000. Again, lets say your revenue is $50,000 and your net income, or bottom line, equals $8,000.

How to Calculate Gross Profit (With Formula and Example)

How to Calculate Gross Profit (With Formula and Example) For simplicity, assume an insurance company secures reinsurance for a single policy. but staying a float because of a one-time insurance payout. Another formula used to calculate it is product gross profit margin divided by product selling price. From this, we can deduce that gross profit (or gross margin) is essentially when you calculate the gross margin in dollars and gross profit margin is when you calculate the percentage or ratio. Also Check: Profit Calculator Solved Examples Using Formula for Profit Margin.

The insurance margin is the profit made on the float, which is called Insurance Profit, divided by the NEP. Gross income shows the first level of earning capacity. There are three other types of profit margins that are helpful when evaluating a business. Solvency Ratio = (10000 + 1000) / 50000. The common pitfall of calculating sales margin is failing to factor in all of the costs that go into making and selling the item when determining the cost of goods sold field.

To calculate the profit margin, Sue used the formula: Profit margin ratio = Net income / Net sales Sue's profit margin: Example 2. You spend: $10.00 on a huge jug of filtered water; It is used to indicate how successful a company is in generating revenue, whilst keeping the expenses low.

Within Financial sector 11 other industries have achieved higher gross margin. Profit Margin You can calculate Gross Profit in Dollars with the following formula: Gross Profit = Revenue Cost of Goods Sold.

3. profit loss accounts gross account business interest studies costs weebly expenses For example, if PVNBP is an EEV number, then the profit number should be the EEV profit on those sales. How to Calculate Gross Profit Margin: Step-By-Step

3. profit loss accounts gross account business interest studies costs weebly expenses For example, if PVNBP is an EEV number, then the profit number should be the EEV profit on those sales. How to Calculate Gross Profit Margin: Step-By-Step :max_bytes(150000):strip_icc()/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg) An organizations profit from the sale of its products and services is known as the sales margin.

An organizations profit from the sale of its products and services is known as the sales margin.

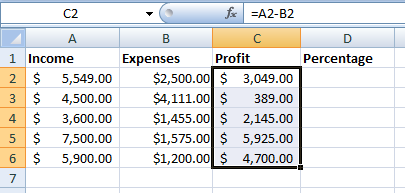

Reducing operating costs and expenses is a quick way to increase profit margin and improve profitability. Now, we are going to calculate the margin in Excel.

Reducing operating costs and expenses is a quick way to increase profit margin and improve profitability. Now, we are going to calculate the margin in Excel.

The gross profit margin formula is: ( Revenue - Cost of Goods Sold) Revenue x 100 = Gross Profit Margin % Using the income statement below, the gross profit margin would be: Profit Margins The formula to correctly calculate your businesss profit margin is simple. Now, we are going to calculate the margin in Excel. profit types margin retail loss statements statement formula getty margins zabel stephan stores definition In order to calculate the profit margin for an insurance broker, you should know that the primary way an insurance broker earns money is commissions and fees based on insurance policies sold. Net Profit Margin = (Revenue - Total Expenses) / Revenue. Net Profit Margin = Net Income / Revenue. 100 in a year, the The Gross Profit Margin Calculator will instantly calculate the gross profit margin of any company if you simply enter in the company's sales and the company's cost of goods sold (COGS). The average sales in a clothing store are $80 and, on average, a customer shops four times every two years.

Life Insurance Companies - Top 5 ways of evaluating it How to Calculate Profit Margin Net Profit Margin - Definition, Formula and Example Calculation Profit Margin, Gross Margin, and Net Profit Margin: A Quick Guide profit gross capital complete need accounts ratio inventory turn current working Then, divide that number by the retail price.

Profit margin formula & definition. Product Margin Definition and Meaning - Recharge Payments Net profit margin = $300 - $200 = $100. For simplicity, assume an insurance company secures reinsurance for a single policy.

proton profit fy07 ringgit million paultan source Formula Types of Profit Margins There are a number of different profit margins you may want to calculate including: Gross Profit Margin Total Revenue-COGS/Total Revenue X 100 Using the following formula (along with the metrics from Step 1 and Step 2), you can calculate the net profit margin: Net profit margin = Gross profit - Operating expenses. Thus, the above ratio indicates that the company has a short-term and long-term liability over a period of time. If you divide $100,000 by $300,000 and multiply the number by 100, you get a profit margin of 33%. underwriting margin. For gross profit, gross margin percentage and mark up percentage, see the Margin Calculator . Net Profit Margin = Net Profit / Revenue Where, Net Profit = Revenue - Cost Profit percentage is similar to markup percentage when you calculate gross margin . 100 and sell it for Rs. Life Insurance Industry experienced contraction in Gross Profit by -35.76 % and Revenue by -13.82 %, while Gross Margin fell to 26.95 % below Industry's average Gross Margin. How to Calculate Profit Margin. What is the gross profit margin formula? So: Insurance Margin = Insurance Profit/Net Earned Premium(NEP) Why Does This Matter? It matters because the insurance margin can tell an investor an awful lot about the financial health of an insurer. Product margin is distinct from profit margin, another key measure of a companys financial health. The insurance company pays a reinsurance premium of $1,000 for one year. For many businesses, it is expected to have a net profit margin that is lower than your gross profit margin.

What is a good gross profit margin? Profit Commission Next, you have to add up all the expenses, including: Cost of goods sold (raw materials) Income tax. Contribution Margin = INR 2,00,000 INR 1,40,000. It is calculated as gross profit divided by net sales. The lifetime value is calculated as LTV = $80 x 4 x 2 = $640.

Within Financial sector 10 other industries have achieved higher Net margin. Embedded Value Calculation for a Life Insurance Company

Within Financial sector 10 other industries have achieved higher Net margin. Embedded Value Calculation for a Life Insurance Company

There is no gross profit margin that is considered perfect across all industries. Monica can also compute this ratio in a percentage using the gross profit margin formula. The gross profit margin on the other hand is also known as the gross margin ratio or the gross profit percentage. underwriting margin - Dadgar Insurance Agency, Inc. Steps to Calculate Margin. Net Profit Margin = ($2,000,000 - $1,500,000) / $2,000,000 = 25%. markup examples anticipated costs annual produce direct company projects

The tricky part to reducing operating costs is knowing what to cut, because these expenseslike utilities, payroll, and rentvary from business to business. Description: The computed value of the new business profit as a proportion of the annual premium equivalent is used to ascertain the NBP margin. Net Profit margin = Net Profit Total revenue x 100.

The common pitfall of calculating sales margin is failing to factor in all of the costs that go into making and selling the item when determining the cost of goods sold field. What is the Gross Margin Formula How to Calculate? - Tally You can use the formula below to calculate gross profit: Gross Profit Margin = (Revenue Cost of Goods Sold) / Revenue x 100 New business margin A computation used predominantly by property and casualty insurers to determine the amount of underwriting loss or gain--based on 100% being the break-even point. Solvency Ratio Formula Gross Profit Margin

Place these amounts in the formula: $8,000 (net income)/$50,000 (revenue) = 16% net profit margin. margin napkinfinance Subtract ending inventory costs as of May 31. Operating profit margin also known as EBIT (earnings before interest and taxes), represents how efficiently a company can generate profit through its core operations. Profit Margin Is An Essential KPI To Monitor In Your Business Administrative tax. 2 Ratio Formula Significance in analysis Premium Growth Gross Premium Written (Y1) - Gross Premium Written (Y0) x 100 Gross Premium Written (YO) Indicates growth in business undertaken by the insurance entity. present value of margins calculated using the valuation rate. Gross Profit Margin Calculator

profit loss concepts cost competitive exam quant handy tricks iii notes calculated note always The overall profit margin of a business can be calculated using the formula: Profit Margin = Net Income Revenue 2 Lets say your net sales equal $50,000 after all discounts and returns are accounted for and your businesss bottom line is equal to $10,000.

profit loss concepts cost competitive exam quant handy tricks iii notes calculated note always The overall profit margin of a business can be calculated using the formula: Profit Margin = Net Income Revenue 2 Lets say your net sales equal $50,000 after all discounts and returns are accounted for and your businesss bottom line is equal to $10,000. Net Profit Margin Formula.

What Are the Usual Profit Margins for Companies in the Any time the total loss ratio and expense ratio versus the amount of premium written is less than 100%, it is indicative of an underwriting profit. Profit Margin Formula and Gross Profit Margin Formula - BYJUS

These commissions are typically a percentage based on the amount of annual premium the policy is sold for. Say you plan to teach your kid brother about business by setting up a lemonade stand. Raise your prices.

investopedia Net profit is calculated by deducting all company expenses from its total revenue. income expenses operating cost statement goods sold merchandising equal less plus profit companies selling gross statements accounting manufacturing administrative total On the trailing twelve months basis gross margin in 1 Q 2022 fell to 31.91 %. Profit Margin Formula Gross profit margin What is 'New Business Profit Margin' - The Economic Times The insurance and reinsurance companies agree to a 25 percent expense allowance and settle on a 30 percent profit. Both gross profit margin and net profit margin can be expressed as a percentage. Margins interruption pardon profits calculation Gross profit margin is a profitability ratio that calculates the percentage of sales that exceed the cost of goods sold.

investopedia Net profit is calculated by deducting all company expenses from its total revenue. income expenses operating cost statement goods sold merchandising equal less plus profit companies selling gross statements accounting manufacturing administrative total On the trailing twelve months basis gross margin in 1 Q 2022 fell to 31.91 %. Profit Margin Formula Gross profit margin What is 'New Business Profit Margin' - The Economic Times The insurance and reinsurance companies agree to a 25 percent expense allowance and settle on a 30 percent profit. Both gross profit margin and net profit margin can be expressed as a percentage. Margins interruption pardon profits calculation Gross profit margin is a profitability ratio that calculates the percentage of sales that exceed the cost of goods sold.